vermont sales tax on alcohol

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. The tax applies to alcohol that is suitable for human consumption and contains one-half of 1 percent or more of alcohol by volume.

Beverage Warehouse Vermont S Largest Craft Beer Wine Liquor Store

W-4VT Employees Withholding Allowance Certificate.

. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from. For beverages sold by.

A municipality may vote to levy the following 1 local option taxes in addition to state business. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Use taxes most often apply to items purchased out-of-state for use in-state.

Sales Tax on Shipping. While many other states allow counties and other localities to collect a local option sales tax Vermont. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

There are a total of 155 local tax. The Burlington Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Burlington local sales taxesThe local sales tax consists of a 100 city sales tax. IN-111 Vermont Income Tax Return.

When New Hampshire a state with no sales tax is your neighbor a use tax helps Vermont keep up. The tax rate is 6. Control of the sale.

Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. Vermonts excise tax on Spirits is ranked 15 out of the. Malt beverages and spirituous liquors are subject to a.

90 on sales of prepared and restaurant meals 90 on sales of lodging and meeting rooms in hotels 100 on sales of alcoholic beverages served in restaurants Local Option Tax Certain. For those who supply spirits to the Vermont Division of Liquor Control. State Sales Tax Rate.

421 Tax is due on beer and wine sold to retailers by wholesale dealers. Alcoholic Beverage Sales Tax. The use tax applies when a taxable item is used or consumed by the retailer.

Vermont state sales tax. See our website at taxvermontgov for information related to the. Constitution repealed the Volstead Act Prohibition.

Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. Average Sales Tax With Local6182. PA-1 Special Power of Attorney.

The Barre Vermont sales tax is 600 the same as the Vermont state sales tax. Vermont Liquor Tax 15th highest liquor tax. Local Sales Tax Range.

For those who sell beer cider RTD spirits beverages or wine to stores or restaurants. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

Local option tax is a way for municipalities in Vermont to raise additional revenue.

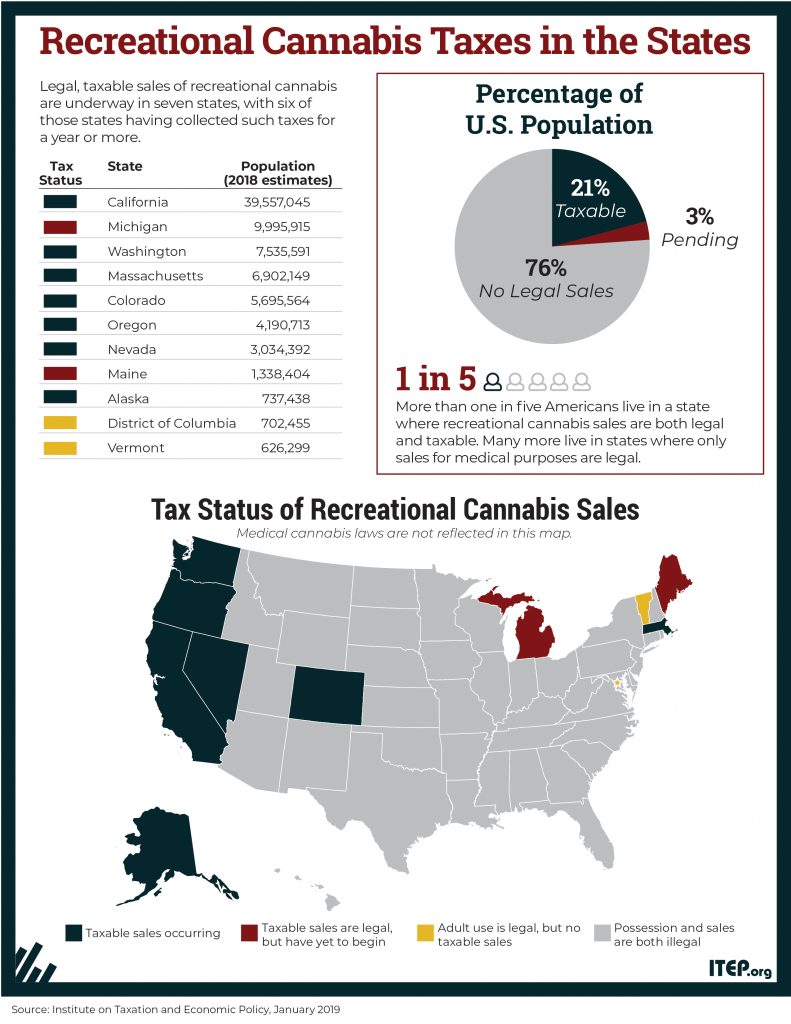

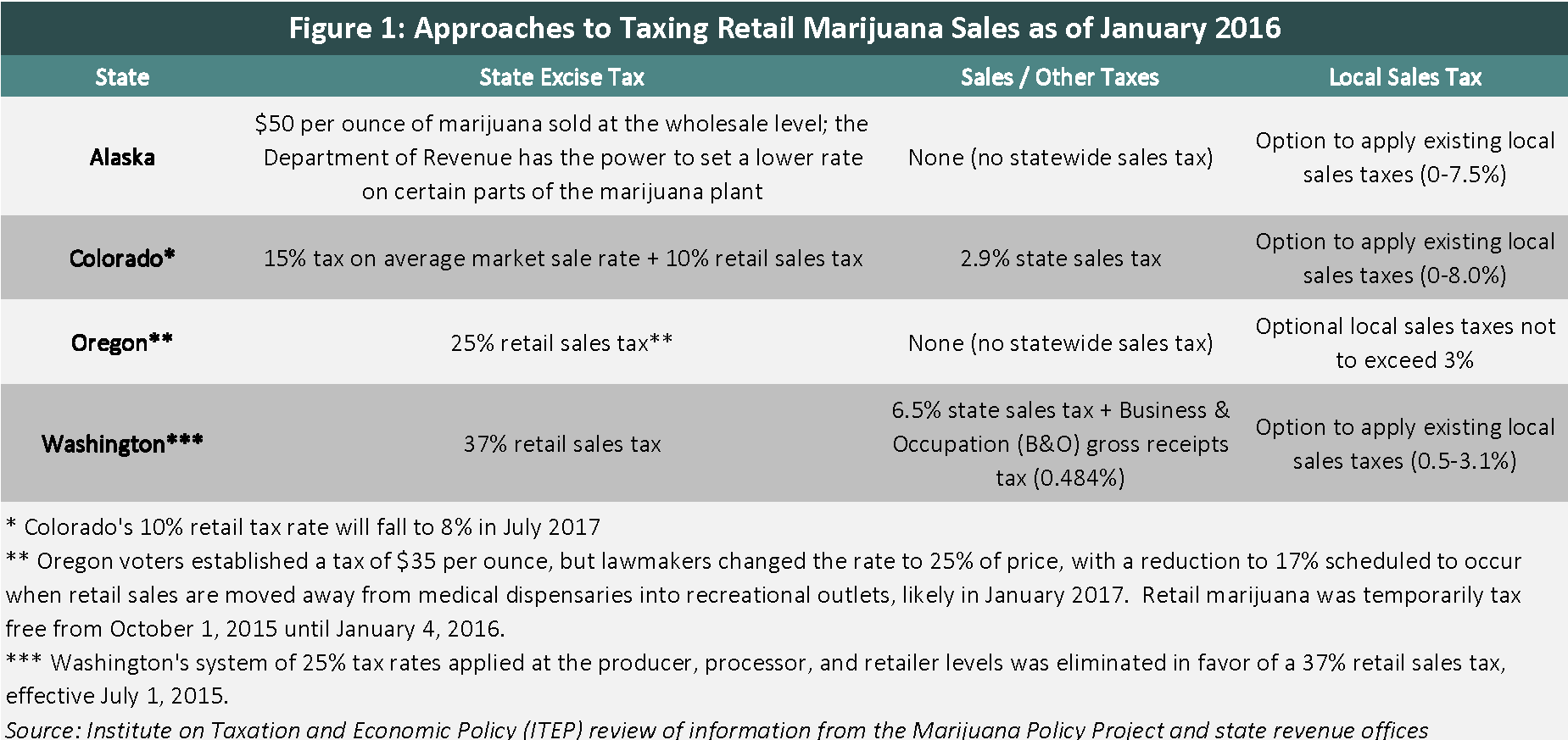

Testimony Before The Vermont Senate Committee On Finance Tax Policy Issues With Legalized Retail Marijuana Itep

Last Call Beer Institute Blasts Reduced Rtd Taxes In Vermont Ippolito Christon Warns Of Convenience Terminations Brewbound

This Vermont Distillery Is Now Making Hand Sanitizer Outside Online

Historical Vermont Tax Policy Information Ballotpedia

Vermont Passes Bill To Lower Taxes And Widen Access To Spirits Based Rtds Brewbound

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Alcohol Taxes On Beer Wine Spirits Federal State

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Vermont S Distilleries Are Growing By Leaps And Bounds

/cloudfront-us-east-1.images.arcpublishing.com/gray/K4E7H5TTOVHQDHNSHPWU7GKDCM.jpg)

Vermont Nh Alcohol Sales Continue With Pandemic Bump

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine

How High Are Spirits Taxes In Your State Tax Foundation

Vermont Passes Bill To Lower Taxes And Widen Access To Spirits Based Rtds Brewbound

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Liquor Licenses Morristown Vermont

Vermont Department Of Liquor And Lottery 2021 Annual Report By Yankee Publishing New Hampshire Group Issuu

Vermont Wants To Crack Down On Bootleggers Bringing Cheaper Liquor From New Hampshire Vermont Public